João da Silva

Business reporter, BBC News

Reuters

Reuters

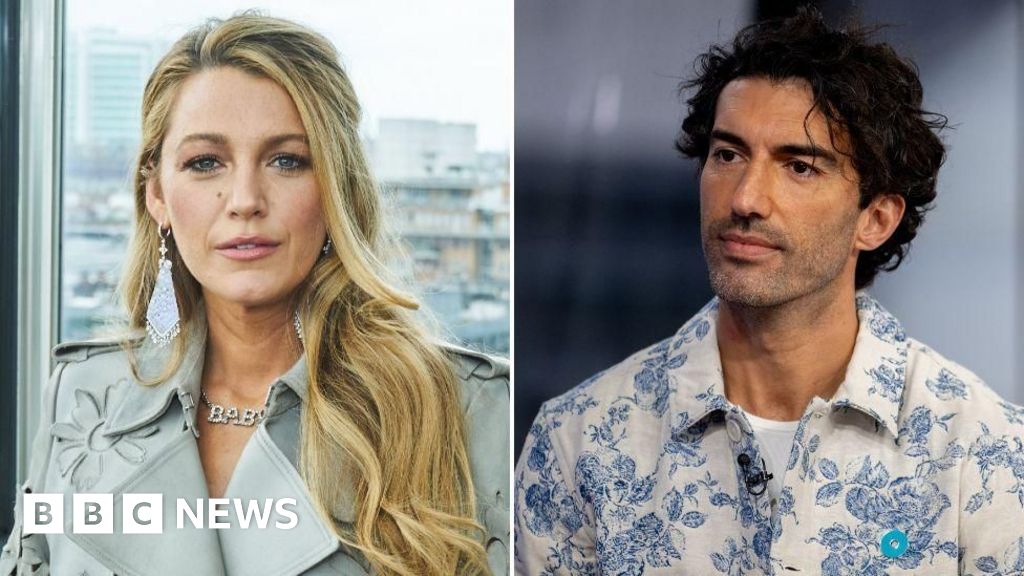

Trump nominated Powell to lead the Fed during his first term in the White House

US President Donald Trump has appeared to soften his recent comments on China and the head of the US Federal Reserve after recent clashes as he pursues his economic agenda.

He said he has "no intention of firing" Jerome Powell after repeatedly criticising the head of the central bank, but he added that he would like Powell to be "a little more active" on cutting interest rates.

Speaking in the Oval Office on Tuesday, Trump also said he was optimistic about improving trade relations with China.

He said the level of tariffs - or import taxes - that he had imposed Chinese imports would "come down substantially, but it won't be zero".

The president's tariffs are an effort to encourage factories and jobs to return to the US. This is a pillar of his economic agenda - as is a cut in interest rates, aimed at reducing the cost of borrowing for Americans.

Trump has ratcheted the rate on Chinese goods up to 145% - sparking reciprocal measures from Beijing and warnings from economists about the global impact of a trade war.

In his comments to reporters on Tuesday, Trump said he would be "very nice" in negotiations with Beijing - in the hope of securing a trade deal.

Earlier, US Treasury Secretary Scott Bessent reportedly said he expected a de-escalation of the trade war, which he said was unsustainable. Responding to comments from China, he said the current situation was "not a joke".

The trade war has led to turbulence in financial markets around the world - to which Trump's comments on Powell have also contributed.

The Fed has not cut rates so far this year, after lowering them by a percentage point late last year, a stance Trump has heavily criticised.

Last week, the president intensified his attacks on the Fed chief, calling him "a major loser". The comments sparked a selloff of stocks, bonds and the US dollar - though markets have since been recovering from those losses.

National Economic Council Director Kevin Hassett said on Friday that Trump was looking into whether it would be possible to sack Powell - who he first nominated to lead the central bank in 2017. Powell was then renewed in 2021 by Joe Biden.

It is unclear whether Trump has the authority to fire the Fed chair. No other US president has tried to do so.

Most major Asian stock markets were higher on Wednesday as investors appeared to welcome the latest remarks.

Japan's Nikkei 225 index rose about 1.9%, the Hang Seng in Hong Kong climbed by around 2.2%, while mainland China's Shanghai Composite was down less than 0.1%.

That came after US shares made gains on Tuesday, with the S&P 500 ending Tuesday's session up 2.5% and the Nasdaq rose 2.7%.

US futures were also trading higher overnight. Futures markets give an indication of how financial markets will perform when they open for trading.

Investors feared that pressure on Powell to lower interest rates could cause prices to rise at a time when trade tariffs are already seen boosting inflation.

Trade tensions between the world's biggest economies, as well as US tariffs on other countries around the world, have triggered uncertainty about the global economy. Those concerns triggered turmoil in financial markets in recent weeks.

On Tuesday, the forecast for US economic growth for this year was given the biggest downgrade among advanced economies by the International Monetary Fund (IMF) due to uncertainty caused by tariffs.

The sharp increase in tariffs and uncertainty will lead to a "significant slowdown" in global growth, the Fund predicted.

Trump has imposed taxes of up to 145% on imports from China. Other countries are now facing a blanket US tariff of 10% until July.

His administration said last week that when the new tariffs are added on to existing ones, the levies on some Chinese goods could reach 245%.

China has hit back with a 125% tax on products from the US and vowed to "fight to the end".

The Chinese government has not yet officially responded to the latest statements from the Trump administration.

However, an article in the state-controlled Global Times on Wednesday quoted commentators who said the remarks showed that the US is beginning to realise the tariffs do more harm than good to America's economy.

1 month ago

82

1 month ago

82