Lizzy Steel

BBC Yorkshire and Lincolnshire Investigations

Reporting fromLeeds

BBC

BBC

Luciana and Enrico Marini lost more than £21,000 after they were unable to gain a mortgage on a home they were in the process of buying

With panoramic views of Leeds, stylish decor and an on-site gym, new parents Enrico and Luciana Marini were dreaming of their future life in their city centre flat.

But after six years of saving, the first-time buyers lost their £21,000 deposit after the new-build apartments were devalued by mortgage lenders they approached.

The BBC has spoken to several prospective owners who were given the same "earth-shaking" news, shattering their finances and plans.

Unable to gain a mortgage and locked into a contract, the developer was legally entitled to keep their deposit - despite the pair having to pull out of the sale.

Mrs Marini says: "They get your money and say, 'don't worry about the mortgage until three years from now.'"

The couple say they felt "pressured" by North Property Group estate agents to proceed with the purchase in 2021, with a non-refundable £5,000 reservation fee locking in a limited time 10% discount.

The couple put down a deposit for a flat at the Phoenix development in Leeds in 2021

Both the agent and a lawyer recommended by the firm told them they did not need a mortgage offer until the £230,000 flat was near completion, the couple say.

"All the money that we were going to invest on our family, things you want for your children, is just lost," Mrs Marini adds.

"It's just devastating."

North Property Group "categorically deny the allegations of high-pressure sales tactics", a spokesperson says.

"All buyers have the right to conduct independent due diligence before committing to a purchase.

"Buyers were informed of the available units and had the opportunity to secure them - no one is ever forced to commit immediately."

The 364-apartment Phoenix development opened in October 2024

"We were first-time buyers and relatively new to the UK, so we weren't really aware of how it worked," says Mr Marini, originally from Brazil.

"It was earth-shaking when we found out we should have got a mortgage offer then."

After more than a year of building delays, the couple approached lenders and were shocked to find mortgage applications refused.

Surveyors cited a range of reasons for devaluing the property, including the location and too many buy-to-let investments.

Torsion Group, the developer, says it can't comment on the independently owned agent, but it "expects them to operate at the highest professional standards".

"The property was built to the finish specified and all the expected structural, safety and quality standards were delivered within the contractual period," a spokesperson says.

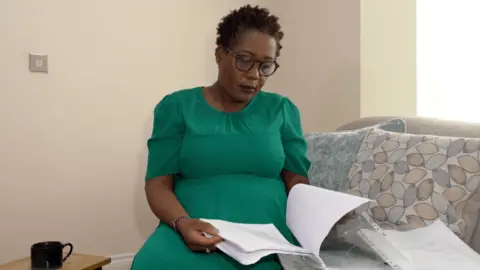

Patience Chinogureyi lost £51,000 in fees, deposits and furniture packs on two flats

"We had really good credit scores, we had enough income to cover the payments, so it was very surprising to us when the mortgage was denied," Mr Marini says.

"I can't express how sad, stressful, demeaning even, it feels," says Mrs Marini, originally from Italy.

When "off-plan" properties are sold it is "common practice to wait until nearer the completion date before making a mortgage application", says Mundy's Specialist Property Lawyers, one of the agent's recommended solicitors.

"The reason is that any mortgage offer issued prior to exchange of contracts would inevitably expire before the completion date and would have to be renewed."

Patience Chinogureyi paid £51,000 in fees, deposits and furniture packs on two Phoenix flats as buy-to-let investments.

When exchanging contracts, she says she was told a mortgage offer was not needed at that stage, as long as she could finance the properties.

Lenders later refused her applications, citing the same property valuation issues.

"I've not been able to sleep because it's all I ever think about," she says.

"I don't know where to start because I've lost that money - I don't know how long it will take me to work and get it back."

North Property Group says buyers are "free to choose their own legal representatives", with a total of 29 independent legal firms advising clients on Phoenix contracts.

Carolyn Barraclough was a cash buyer and fears her flat may not be worth what she originally paid

Carolyn Barraclough successfully bought one of the flats, near the A61, for her son using money from an inheritance, but he never moved in due to building delays.

"The agent said she would hold the property for me for an hour, so I got a taxi down to the office," she recalls.

"I was told I would need to place a reservation fee immediately because somebody else had already been on the phone - if I left the building it was going to go to them and it was the last one."

Ms Barraclough says she was never advised to have the flat valued and is worried she might not be able to sell.

"It was obvious that I was new to this type of thing, I've never purchased a property before for an investment other than the house I live in," she says.

"I didn't know any of the pitfalls."

Developers say Phoenix is the fourth tallest residential building in Leeds

Offering advice on best practice, Sarah Cookson, director of Switalskis solicitors, says buyers should always gain a mortgage offer before exchanging contracts and paying a deposit - even when buying off-plan.

"It is very unusual not to advise a client to do this," she says.

"A mortgage offer and valuation is critical - a surveyor would still be able to value what is going to be built.

"They would look at the documents and say whether or not it is a good buy."

She adds: "You wouldn't buy a car that hasn't got an MOT certificate, why would you buy a house without having it valued?"

Sarah Cookson, director of Switalskis solicitors, advises never to exchange contracts before a mortgage offer is in place

All buyers spoken to by BBC News say they would have obtained mortgage offers before exchanging contracts if they had been advised to do so.

North Property Group says: "Buyers were informed that mortgage offers are typically valid for six months, which is standard for off-plan purchases.

"Lenders appoint surveyors independently to assess property values, and market conditions have shifted significantly in recent years, affecting mortgage approvals."

It adds: "Since 2017, North Property Group has successfully brokered 1,007 sales.

"Of those transactions, 857 were off-plan purchases."

A spokesperson for Mundy's Specialist Property Lawyers says: "We are aware that some buyers have unfortunately been unable to complete their purchase of apartments within The Phoenix.

"We of course have every sympathy with those buyers and are extremely sorry for the difficulties they have faced.

"Nevertheless, it has to be said that we have acted for many clients who have completed their apartment purchase without any particular issues."

They add: "We do not accept the suggestion that we failed to give proper legal advice to any buyer on this development or that we failed to explain the risks so far as they relate to property acquisition."

3 months ago

90

3 months ago

90