Josh MartinBusiness reporter

Getty Images

Getty Images

Retail sales fell unexpectedly in November as Black Friday discounts failed to boost spending, official figures show.

Supermarket sales fell for the fourth month in a row, while discounts at retailers across November did not lift Black Friday spending as much as in recent years, the Office for National Statistics (ONS) said

Analysts had expected total sales volumes to rise by 0.4% in November. Instead, they fell 0.1%, however, sales in recent months have increased thanks to more computers, clothing and furniture purchases.

A separate survey released on Friday suggested shoppers have been willing to spend in lead-up to Christmas, with consumer confidence in December matching a 16-month high.

The GfK consumer confidence survey also found households were feeling better about their finances in the year ahead than they were previously, although both measures are still negative overall.

Interest rates being cut to 3.75% on Thursday could strengthen that confidence and "retailers will hope this can spur a rebound in consumer spending," Oliver Vernon-Harcourt, head of retail at Deloitte said of the crucial pre-Christmas trading period.

However some analysts said the weeks of pre-Budget uncertainty had dented shoppers' confidence to spend.

"The chaotic run-up to the Budget hit consumer spending, driving retail sales into two consecutive monthly falls after a run of four rises from June to September," Rob Wood, chief UK economist at Pantheon Macroeconomics said.

The ONS's survey of households showed 31% of adults said they planned to take advantage of Black Friday deals on offer, but 19% said they planned to buy less than last year.

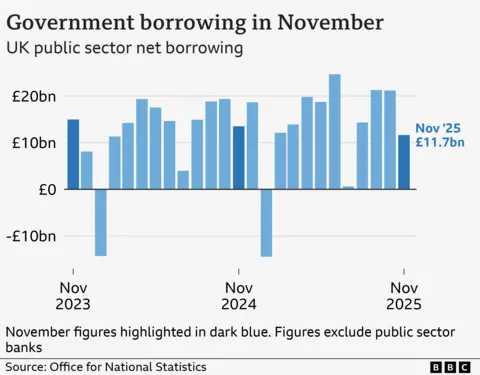

Separately, the ONS announced on Friday that UK government borrowing was higher than expected last month.

Borrowing - the difference between public spending and tax income - was £11.7bn in November, whereas analysts had been expecting about £10bn.

However, the figure was £1.9bn lower than in the same month last year and was the lowest November borrowing for four years. The Office for National Statistics (ONS) said the fall was mainly due to higher receipts from taxes and National Insurance contributions.

Government borrowing for the financial year to November has now reached £132.3bn, which is £10bn ahead of where it was at the same point last year.

Part of that is down to the government reversing a decision to restrict winter fuel payments, as well as paying higher salaries in the public sector and inflation-linked benefits.

Chief Secretary to the Treasury James Murray said last month's Budget would "deliver on our pledge to cut debt and borrowing."

"£1 in every £10 we spend goes on debt interest - money that could otherwise be invested in public services," he said.

But Shadow chancellor Mel Stride said the government was "piling up ever higher debt".

"Having scrapped the two-child benefit cap and abandoned welfare reform, Labour are borrowing more and more to fund irresponsible spending," Stride said.

The government would need to "deliver a significant slowdown in borrowing over the next few months" if it is to hit the Office for Budget Responsibility's target of £138.3bn for the current financial year, Matt Swannell, chief economic adviser to the EY Item Club said.

2 months ago

71

2 months ago

71